Table Of Contents

What Is Turnover Ratios Formula?

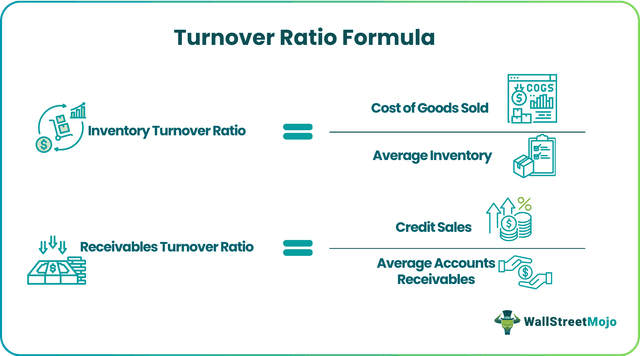

Turnover ratios measure how efficiently the facilities, including the assets and liabilities of the organization, are utilized. The turnover ratios formula includes inventory turnover ratio, receivables turnover ratio, capital employed turnover ratio, working capital turnover ratio, asset turnover ratio, and accounts payable turnover ratio.

These ratios help the analysts and stakeholders understand how effectively the business is able to generate revenue using its resources. It is often used to compare businesses with their competitors to analyse the performance, growth, and future opportunities so stakeholders can make informed investment decisions.

Turnover Ratios Formula Explained

The turnover ratios formula indicates how efficiently the assets and liabilities are managed in a particular period. It gives an idea to the stakeholders regarding how fast the business is able to sell the goods and services that is has acquired as inventory or manufactured using the raw materials.

The manufacturing company has to purchase and store the raw materials that it uses for production. There is cost involved in the acquisition process in the form of purchase, transportation as well as storage. In case of perishable goods this cost goes up because of some special arrangements that these products require during the transportation and storage process. Thus it is necessary to sell off the final goods as fast as possible so that wastage is minimum and revenue is maximum. In this case, the inventory turnover ratios formula gives an idea about the efficiency level of the business.

Turnover ratio is also used to measure the receivable cycle which is very important for any business because it shows how quickly the company is able to collect its dues. If this cycle is long, it signifies that cash is blocked and cannot be used for daily operations which may lead to cash crunch and borrowing.

Similarly, the asset turnover and working capital turnover ratios gives an idea about the level of asset utilization and effective sales generation using the working capital of the business respectively.

Thus, any type of turnover ratio formula accounting measures how well and how fast the company is able to convert its resources into useful products and sell them in the market to earn revenue. The lesser the time taken the better it is because it signifies a high level of operational efficiency.

Video Explanation of Turnover Ratios

Types

Given below are the various types of ratios that are used by the management and analysts to calculate the turnover level and understand the efficiency of the business operations.

The inventory turnover ratios formula measures how efficiently and quickly the business is able to sell the old stock and replace it with new stock of goods.

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory.

The Receivables turnover ratio indicates the effectiveness of a company in collecting its debts.

Receivables Turnover Ratio = Credit Sales / Average Accounts Receivable

The capital employed turnover ratio indicates the efficiency with which a company utilizes its capital employed with reference to sales.

Capital Employed Turnover Ratio = Sales /Average Capital Employed.

Working Capital is the difference between the current assets and current liabilities of a company.

Working Capital Turnover Ratio indicates the efficiency with which a company generates its sales with reference to its working capital.

Working Capital Turnover Ratio = Sales / Working Capital

The asset turnover ratio is a measure of a company’s ability to utilize its assets for the purpose of generating revenues.

Asset Turnover Ratio = Sales/ Average Total Assets.

The accounts payable turnover ratio measures the speed with which a company pays off its suppliers.

Accounts Payable Turnover Ratio =Supplier Purchases / Average Accounts Payable

How To Calculate?

Let us understand the different turnover ratio calculation formula and how to calculate them in details.

#1 - Inventory Turnover Ratio

In order to calculate the inventory turnover ratio, we should undertake the following steps:

Step 1: We need to calculate the cost of goods sold. The cost of goods sold is computed by adding the beginning inventory to the purchases made during the period and subtracting the ending inventory for the period.

Cost of Goods Sold = Beginning Inventory + Purchases During the Period – Ending Inventory.

Step 2: The average inventory should be calculated by using the formula mentioned below:

Average Inventory = Opening Inventory + Closing Inventory/2

Step 3: The inventory turnover ratio is required to be calculated. The result can be obtained by using the formula mentioned below:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

#2 - Receivables Turnover Ratio

In order to calculate the receivables turnover ratio, we should systematically follow the steps mentioned below:

Step 1: Calculate the total credit sales. Credit Sales are the purchases made by the customers for which payment is given on a later date and is hence delayed.

Step 2: We should compute the average accounts receivable by using the formula:

Average Accounts Receivable = Opening Accounts Receivable + Closing Accounts Receivable /2

Step 3: Calculate the receivables turnover ratio calculation formula by using the formula mentioned below:

Receivables Turnover Ratio = Credit Sales / Average Accounts Receivable

#3 - Capital Employed Turnover Ratio

To calculate the above ratio, the steps are as given below:

Step 1: Calculate the total sales

Step 2: Compute the average capital employed by using the formula mentioned below:

Average Capital Employed = Opening Capital Employed+Closing Capital Employed/2

Step 3: Calculate the capital employed turnover ratio by using the formula mentioned below:

Capital Employed Turnover Ratio = Sales / Average Capital Employed

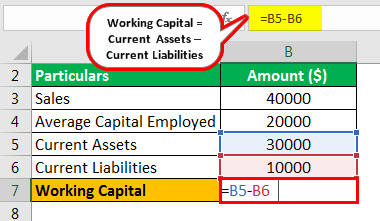

#4 - Working Capital Turnover Ratio

In order to calculate the working capital turnover ratio, the following steps are required to be followed:

Step 1: Calculate the total sales. This refers to the total amount of sales conducted by a firm in a given period of time.

Step 2: Calculate the working capital by using the formula mentioned below:

Working Capital = Current Assets – Current Liabilities

Step 3: Compute the working capital turnover ratio by using the working capital turnover ratio formula mentioned below:

Working Capital Turnover Ratio = Sales / Working Capital

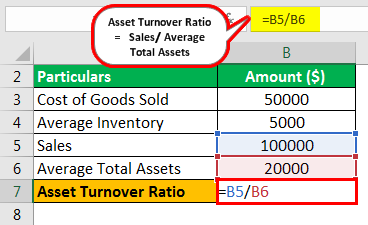

#5 - Asset Turnover Ratio

In order to calculate the asset turnover ratio, we should follow the following steps:

Step 1: Find out the sales

Step 2: Calculate the average total assets by using the formula mentioned below:

Average Total Assets = Opening Total Assets + Closing Total Assets / 2

Step 3: Calculate the asset turnover ratio. The formula can be computed as follows:

Asset Turnover Ratio = Sales / Average Total Assets

#6 - Accounts Payable Turnover Ratio

In order to calculate the accounts payable turnover ratio, carry out the following steps:

Step 1: Find out the Supplier Purchases

Step 2: Calculate the average accounts payable. For this purpose, the following formula should be used

Average Accounts Payable = Opening Accounts Payable + Closing Accounts Payable /2

Step 3: In this step, the accounts payable turnover ratio should be calculated by using the formula:

Accounts Payable Turnover Ratio = Supplier Purchases / Average Accounts Payable

Examples

Let’s see some simple to advanced practical examples of turnover ratio formula accounting to understand it better.

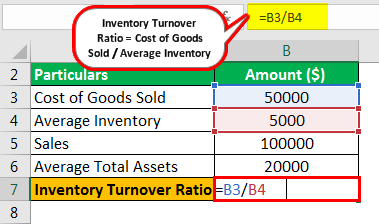

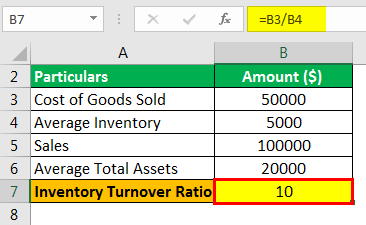

Example #1

Georgia Inc. gives you the following information. From the above information, you are required to calculate the Inventory Turnover Ratio and Asset Turnover Ratio.

- Cost of Goods Sold: 50000

- Average Inventory: 5000

- Sales: 100000

- Average Total Assets: 20000

Solution

Calculation of Inventory Turnover Ratio

- =50000/5000

Inventory Turnover Ratio will be -

- Inventory Turnover Ratio = 10

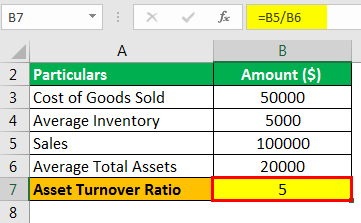

Calculation of Asset Turnover Ratio

=100000/20000

Asset Turnover Ratio will be -

- Asset Turnover Ratio =5

The Inventory Turnover Ratio is 10, and Asset Turnover Ratio is 5.

Example #2

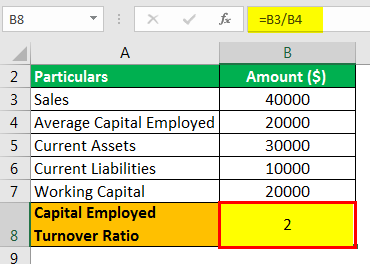

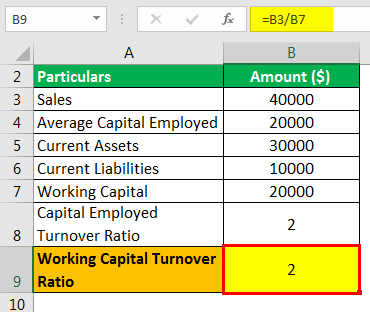

Credence Inc. gives the following information about its business. Calculate the following a)Capital Employed Turnover Ratio. b) Working Capital Turnover Ratio.

- Sales: 40000

- Average Capital Employed: 20000

- Current Assets: 30000

- Current Liabilities: 10000

Solution

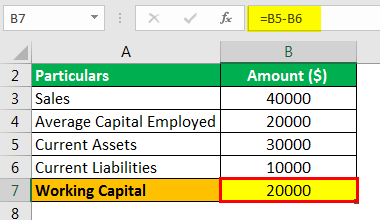

Calculation of Working Capital

=30000-10000

Working Capital will be -

Working Capital = 20000

Calculation of Capital Employed Turnover Ratio

=40000/20000

Capital Employed Turnover Ratio will be-

- Capital Employed Turnover Ratio = 2

Working Capital Turnover Ratio

=40000/20000

Working Capital Turnover Ratio formula will be -

Working Capital Turnover Ratio = 2

The Capital Employed Turnover Ratio is 2, and Working Capital Turnover Ratio is 2.

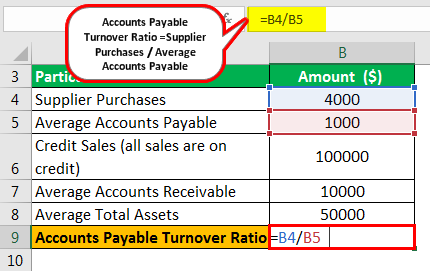

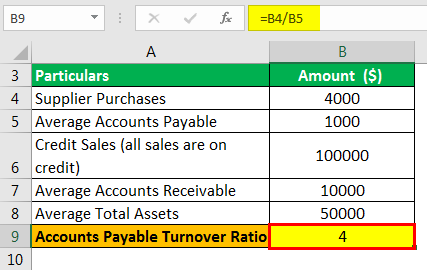

Example #3

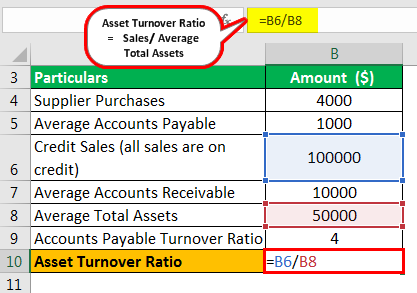

Merwin Inc. gives you the following financial information for 2018. Calculate the following efficiency ratios: a) Accounts Payable Turnover Ratio. b) Asset Turnover Ratio. c)Receivables Turnover Ratio.

- Supplier Purchases: 4000

- Average Accounts Payable: 1000

- Credit Sales (all sales are on credit): 100000

- Average Accounts Receivables: 10000

- Average Total Assets: 50000

Solution

Calculation of Accounts Payable Turnover Ratio

=4000/1000

Accounts Payable Turnover Ratio will be -

- Accounts Payable Turnover Ratio = 4

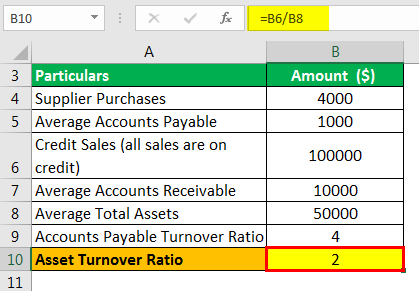

Calculation of Asset Turnover Ratio

=100000/50000

Asset Turnover Ratio will be -

- Asset Turnover Ratio = 2

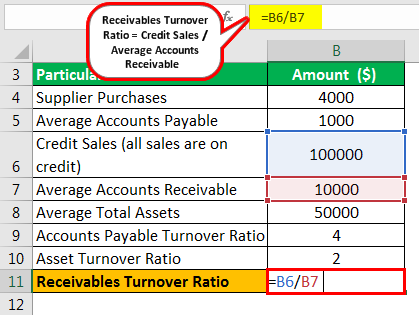

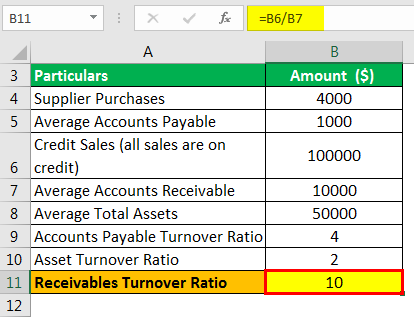

Calculation of Receivables Turnover Ratio

=100000/10000

Receivables Turnover Ratio will be -

- Receivables Turnover Ratio = 10

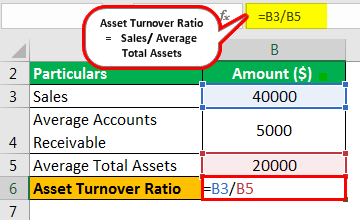

Turnover Ratios Formula in Excel (with Excel Template)

The Finance Manager of Prudent Inc. is interested in finding out different ratios. Calculate the following ratios assuming all sales are on credit: a)Asset turnover Ratio b) Receivables Turnover Ratio.

The information is as below:

- Sales: $40000

- Average Accounts Receivable: $5000

- Average Total Assets: $20000

Solution

Step 1: Insert the formula =B3/B5 in cell B6 in order to calculate the asset turnover ratio.

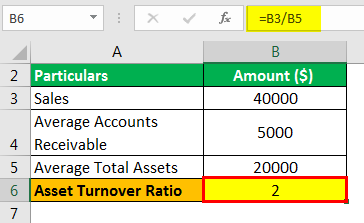

Step 2 : Press Enter to get Result

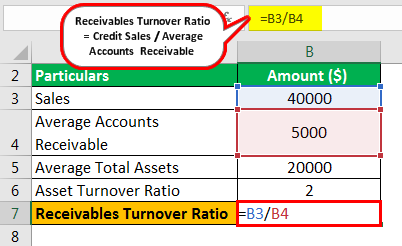

Step 3: Insert the formula =B3/B4 in cell B7

Step 4 : Press Enter to get Result

The Asset Turnover Ratio is 2, and the Receivables Turnover Ratio is 8.

Uses

Such a formula has several uses in the business for managerial decisions as well as the various stakeholders who have some interest in the business in the form of lending or investment in the form of capital.

The inventory turnover ratio indicates the speed at which the company can move its inventory. The receivables turnover ratio indicates how fast a company can turn its receivables into cash. The capital employed turnover ratio indicates the ability of a company to generate revenues from the capital employed. The higher the working capital turnover ratio, the higher the efficiency of the company to use its short-term assets and liabilities for the purpose of generating sales.

A low asset turnover ratio indicates that the company is not being efficient in utilizing its assets for the purpose of generating sales. The number of times a company pays off its suppliers during a period is given by the accounts payable turnover ratio.